U.S. Economy – Consumer Credit Risk?

The Federal Reserve Bank of New York recently published the latest Household Debt and Credit report for the fourth quarter of 2025.

Maybe it’s not time to panic, but there are some points worth watching as 2026 unfolds. Typically, credit markets must collapse to trigger a recession. But for now, credit markets remain liquid.

A few points of reference:

- Q4 credit data shows fast growth but manageable volume.

- Delinquencies are increasing, but would need to double to trigger a crisis.

- Bank reserves remain solid; credit markets stay accessible.

- New foreclosure notations rose to 58,000 individuals in Q4, up from the previous quarter.

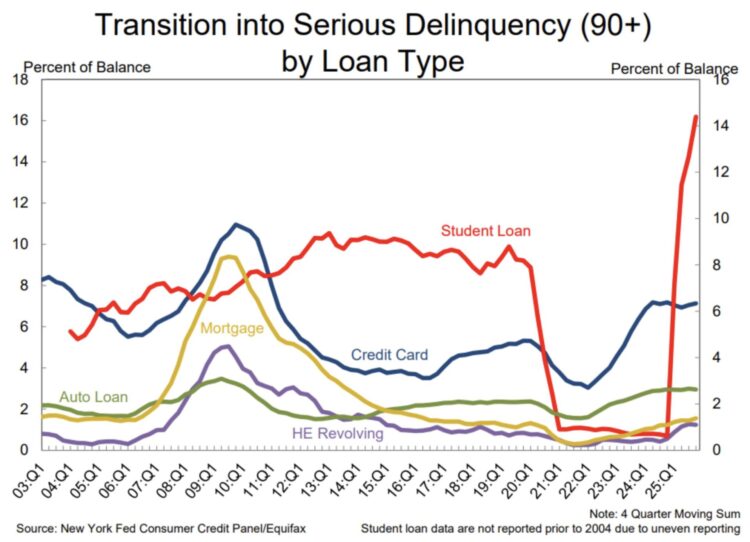

- Three of the five categories in the chart are at levels not seen since the Great Recession.

For historical context, mortgage and home equity loan categories are the most important. Although they are increasing, they remain within a historically low range; both would need to double or triple their current percentages to reach levels associated with Great Recession risk.

U.S. Supply Chain

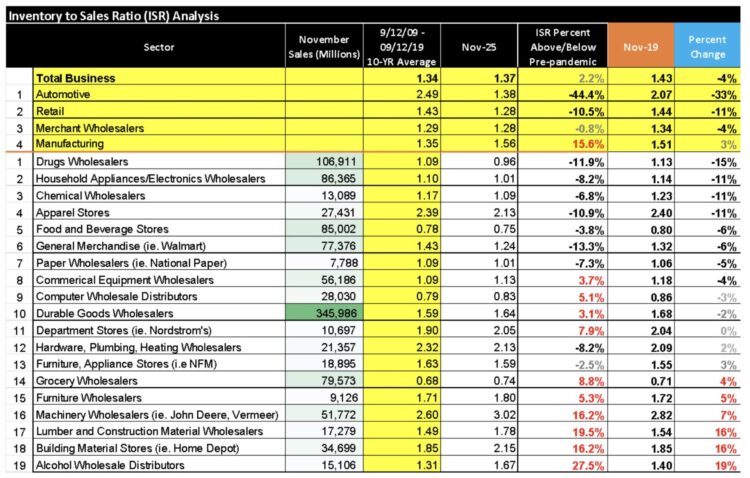

Reviewing the data, it seems that only 19% of the U.S. market was overstocked through November. Typically, this time of year is peak inventory season as companies prepare for the holiday shopping period.

For comparison, the percentage overstocked in March 2025 was 59%.

It appears inventories may have finally rebalanced, and the anticipated demand cycle should help the transportation sector.

Approximately 42% of firms are understocked, while another 39% are balanced.

That 42% is understocked and aligns with last month’s ISM results, which might prompt some scrambling to keep inventories in check. They are now operating lean enough that any small disruptions in transit or upstream logistics issues could cause immediate challenges.