Flash PMI Report for May Stuns

S&P Global gives us a sample of about 80% of the monthly surveys collected to date in their Flash Report each month. Most thought US data would come in weaker in the latest data, but they were proven wrong.

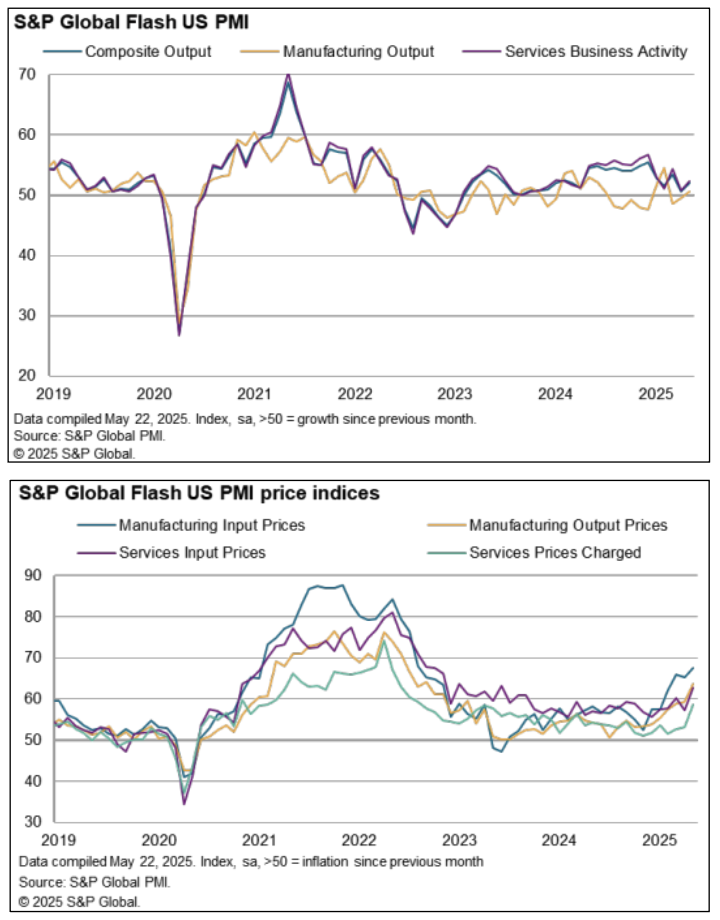

The services sector (which usually accounts for ~60-70% of US macroeconomic activity) came in at 52.3, up from 50.8 and firmly in expansion territory.

The manufacturing sector, which all expected to soften quite a bit this month, came in much stronger at 52.3, up from 50.2 last month.

If there was a major concern, it came in the prices components. All of the measures of price surged in the month on both the input and output sides. Comments by manufacturers and services firms alike pointed to the impact of tariffs on operating conditions and inflation. Prices were the highest since 2022 but are still off of highs seen coming out of the pandemic and global supply chain crisis in 2021.

The official PMI report will be released on or shortly after the first of the month.

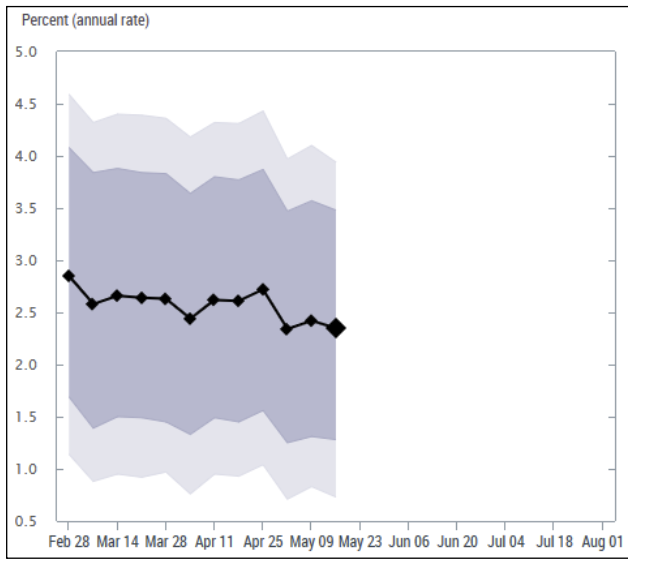

New York Fed Shows 2.35% Growth for Q2

The Atlanta Fed GDPNow forecast is the one usually referenced by experts, but another Federal Reserve has a competing rolling forecast for GDP. The New York Fed has a forecast that uses similar methodology, and it gives another check point to consider.

If there is any point to make in this reading it is that everyone should pay attention to the deceleration trend in the data from the beginning of the quarter. Typically, in a quarter, experts watch the data trend and get an idea of where it might end up by the end of the quarter. With much of the April 2nd reciprocal tariff shock and the resulting ebbs and flows of trade policy moving markets, the upcoming data releases have the potential to be generally softening.

Does that mean that Q2 comes in contracting? No, probably not. Will it continue to trend this strong with growth of nearly 2.4%? Also, probably not.

The Blue Chip estimates show it netting out at about 1% for Q2, and that will likely be about right. That being said, the Flash PMI report from S&P Global came in surprisingly strong on both services and manufacturing fronts. So, seeing it come in at 2% or greater should not surprise people in the least – and then Q3 has the potential to come in much stronger with the inbound wave of containers headed toward the US, some trade deals getting announced in the next thirty days, the budget agreement getting finalized and signed, etc.

Said another way, the potential for both sentiment and animal spirits investments will get much better with 1) tax certainty and 2) confidence in the forward-looking trade environment. Everything else is a bonus.