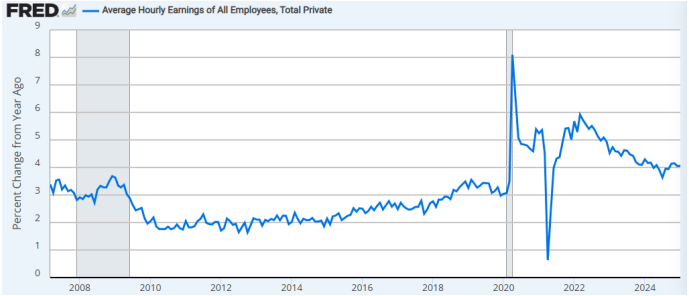

Important Wage Growth Data in January

The labor report showed that wages were still elevated. Coming in at a 4.1% annual growth rate, this was consistent with the past 4 months of data and a rate that remained higher than at any time prior to the pandemic. This is still a problem for many firms trying to attract, hire, and retain talent. Coupled with a drop in the unemployment rate in January, it suggests a labor market that is remaining tight for now.

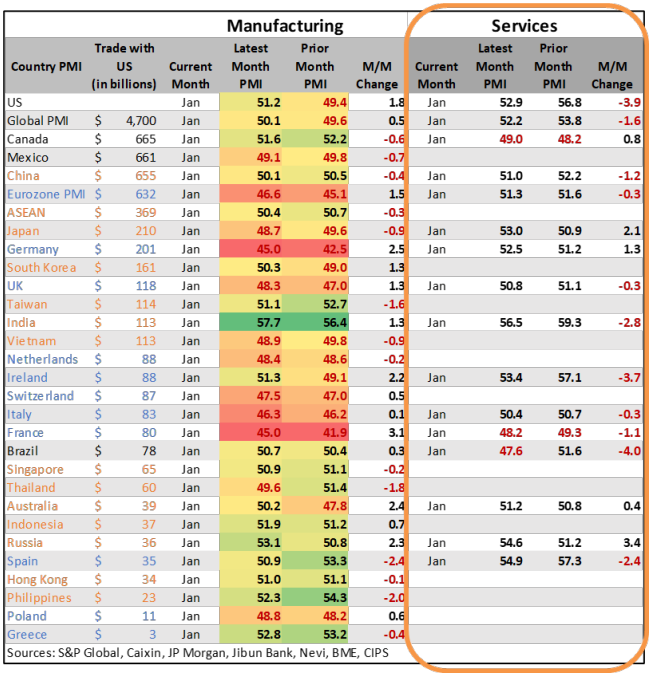

Global Services Dip in January – Weather or Something Else?

The services sector PMI’s (Purchasing Manager’s Indexes) typically accounts for roughly 75% of a developed nation’s economy, and January data gave everyone a bit of a shock on a global basis.

The US saw a 3.9 point drop to 52.9. This was still in expansion territory, but there was a notable drop. S&P Global reported that the dip was partly weather related. Strong winter storms hitting on weekends kept many consumers at home, affecting total retail spending. If this is the case, there may be a rebound in February data when it is released.

The headline Global PMI figure (in which the US weighs heavily) was also down 1.6 points to 52.2.

Despite many countries seeing deceleration, only three had PMIs in the red. Brazil was struggling with the lowest PMI, driven by a dip in the Brazilian real (down 27% against the USD in 2024) which pushed input costs to 2.5-year highs. Services inflation in the country was running 6% in January, and tighter credit conditions and elevated interest rates are keeping consumers sitting on their cash.

Canada also had a weak showing but was only in mild contraction at 49 points. Canada’s economy is in a state of flux. Political turnover, tariff risk with the US, currency volatility, poor weather conditions, and a bit of a pullback in the US and Mexico economies all weighed on Canada.

Russia had the second strongest services PMI in January. It could be bad surveys, but the services sector should probably be weaker than it is. For Russia right now:

- Military spending accounts for 8% of GDP – which drives defense related spending but also increases ancillary sectors like hospitality and retail near military hubs.

- Federal tax revenues were still 73% higher in 2025 and government subsidizing industries was keeping wages stable.

- Defense industry wages have surged, spurring social spending and consumer retail spending. And with many Russian citizens forced to stay in-country, tourism/leisure services in the country are doing well.

- The government is helping subsidize lending at a banking level, helping keep businesses afloat.

- Problems still exist. Inflation is now rising at its fastest rate in more than a year, and labor shortages are rising. Some estimates suggest that the economy has lost more than 1.6 million skilled workers to conscription and shifting employment dynamics.

- Tougher sanctions imposed late in 2024 are likely to have an impact.

Overall, the services PMIs are not giving a global recession signal, but the slowdown in January was notable. Another month of data may show if better weather, getting beyond the Lunar New Year, and other factors will allow things to reverse course.

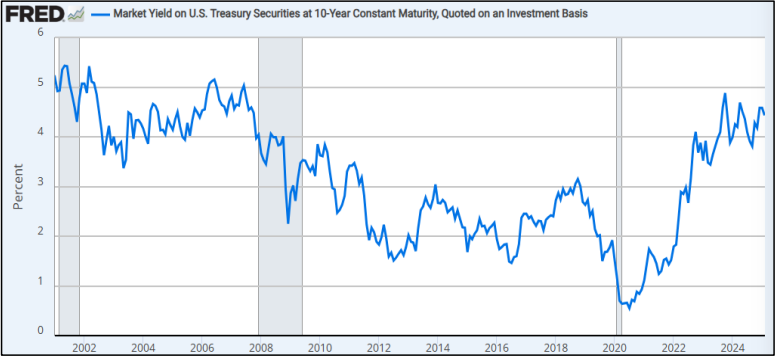

Bessent Says Focus is on 10-Year Treasury

Treasury Secretary Bessent stated that getting the 10-Year Treasury down was the primary focus in the near term. This rate controls long-term interest rates like mortgages and corporate borrowing – and it is critical in a faster, more robust economic growth cycle.

These are the focus on the economic front:

- Fiscal Tools, Not Fed Pressure

- Prioritizing fiscal policy (spending/tax decisions) over pressuring the Fed to cut short-term rates.

- Focusing on the 10-year Treasury yield rather than the Fed’s benchmark rate.

- Debt Issuance Management

- Maintaining current sales of long-term debt through mid-2025.

- Keeping long-term debt issuance steady to avoid flooding the market with bonds that could push yields higher, stabilizing borrowing costs.

- Fiscal Policies to Lower Yields

- Cutting government spending and shrinking the deficit to reduce borrowing needs and ease upward pressure on yields.

- Making the 2017 Tax Cuts and Jobs Act permanent and reducing regulations to boost economic growth without inflation, theoretically keeping rates low.

- Increasing oil/gas production to lower energy costs, which Bessent claims will reduce inflation expectations and long-term yields.

Remember that mortgage rates typically run at a premium of 1.7 percentage points on top of the 10- Year Treasury. Most analysts are calling for a US Treasury rate closer to 4% by the end of the year, which suggests that mortgage rates would pierce the 6% range. That would be down sharply from the 6.8% current rate and would be enough to trigger stronger housing activity. But if the administration is able to build more momentum, the 10-Year has historically shown the ability to adjust more rapidly. During the first Trump term, the 10-Year fell from 3.15% in October of 2018 to 1.5% just prior to the start of the pandemic.

Certainly, the US deficit and inflation risk are higher than they were then, but that is the focus of DOGE (controlling government spending) and reducing energy inflation (a key input cost for nearly the entire economy). It remains to be seen how effective these efforts can be. The current yield rate was 4.495% in the wake of the recent jobs report.