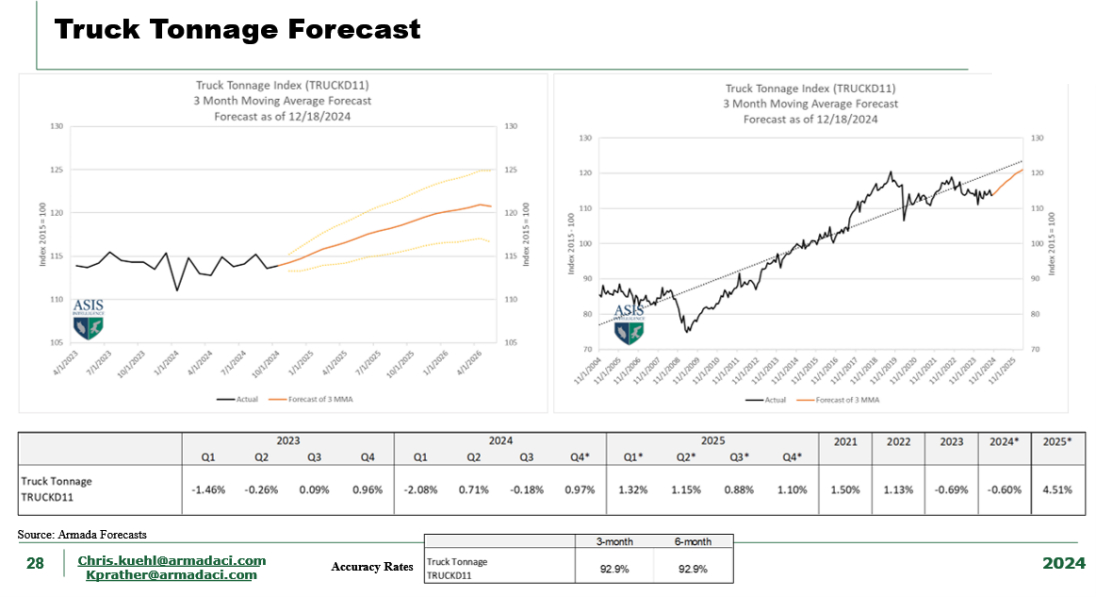

Sneak Peak on Truck Tonnage Forecasts

The current outlook is strong, and it almost seems to be unrealistic. But this outlook is plausible for many reasons. The outlook shows a recovery after nearly 24 months of difficult conditions across the transportation sector. It has been a secular recession driven heavily by inventory overstocks that were prevalent coming out of the global supply chain crisis in 2021 and 2022.

But the models below are showing a strong recovery cycle. If they don’t adjust downward, expect improvement in everything from manufacturing activity for trucks, trailers, chassis, and anything used in the logistics sector to the movement of products, intermodal activity, energy demand and use, raw material demand, etc. It could set the stage for a strong recovery process. Even if consumer demand is fairly flat yearover-year, the need to rebuild inventories and replace an item for every item sold will create new activity.

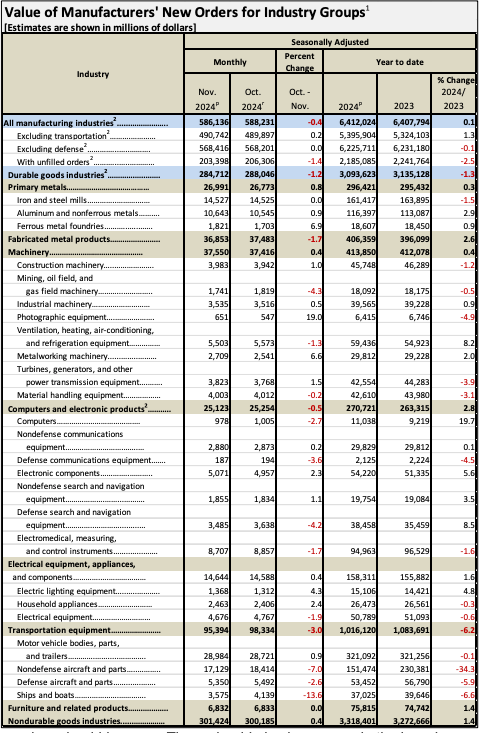

New Orders by Sector Show Strengths

This version of the final durable goods new orders gives more detail on specific sectors.

Overall, durable goods new orders were essentially unchanged for the year and had been decelerating late in the year. New orders were up just 0.1% Y/Y, and they fell 0.4% M/M.

But there were some sectors that provided good growth.

Under computers and electronic equipment (which was the fastest growing major sector in the report with 2.8% Y/Y growth), the fastest growing sub-sector was computer manufacturing with growth of nearly 20%. Growing strongly was defense-related search and navigation equipment, which grew at 8.5% on nearly $3.5 billion in sales.

Fabricated metals were also growing at a firm rate, rising by 2.6%. But the rest of the sectors in the report were weak. Transportation equipment was an especially weak category.

There is some good news because, after a year of no growth, nondefense aircraft manufacturing and new orders should improve. There should also be a surge in the broader transportation equipment in trucking and other types of revenue-generating equipment.

Mexico Moves to Reduce Imports

Over the last few years, Mexico has watched its trade deficit with China swell dramatically. That deficit now stands at $105 billion. Claudia Scheinbaum has announced the formation of a new plan designed to reduce that deficit by expanding the productive capacity of Mexican manufacturing.

There are three motivations for this effort. The first, of course, is to boost the economy and stimulate job development, but two others also stand out. It is a gesture to the US in that it addresses the claim that Mexico has become a way for China to avoid tariffs and other restrictions. China can export to Mexico, make modifications, and then ship to the US. In addition, this is also a way to impact China by limiting its export opportunities.

Transportation Getting Ready for 2025

Orders for Class 8 trucks rose 39% year-over-year according to ACT Research. Trucking firms are anticipating a better freight environment in 2025 and 2026 and will be ramping up new capacity to prepare. There isn’t a lot of detail to show how many of trucks are alternative energy units (to prepare for tougher emissions standards in California). Courts have protected California’s mandates on trimming emissions, and heavy-duty freight companies that want to continue to do business in California are planning for tougher standards.

On a broader basis, this uptick in Class 8 orders is a good sign for the broader economy. Other than using new orders for normal replacement cycles, new orders for these semis typically lead increases in freight activity by 6-8 months.