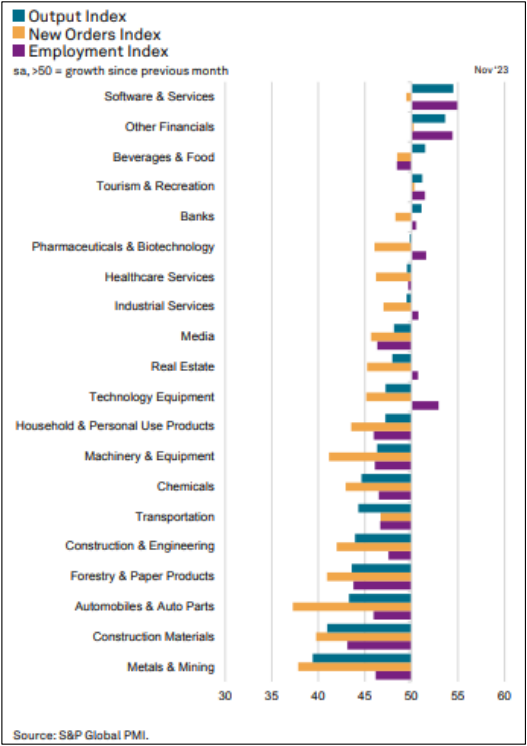

What Sectors Were Showing Growth in November on a Global Basis?

The chart from the S&P Global monthly sector report shows that software and services have the strongest output of any sector in the report, followed by other financials and food/beverage. These sectors are generally showing growth in both factory and services output and employment/hiring.

Tourism and recreation showed some mild improvement as did the banking sector.

So, demand for global commodities that are used in construction activity should be at some of the lowest demand levels in this cycle. That doesn’t mean that US prices for those materials are dropping, but suppliers in that sector should start to expect some strong global competition coming from foreign producers. Those producers have products in inventory, a strong dollar discounting their prices, and construction firms that are finding the time to shop competitively.

The last takeaway from the chart is that there are a lot of weaknesses across most of the global complex. In addition, the chart allows us to easily see which industries are hanging onto talent. The high-tech, pharma, and financial sectors’ hiring is steady and growing, despite those sectors generally being somewhat flat from a demand perspective. They have had so much difficulty trying to find quality talent that they aren’t willing to go through layoffs – at least at this time.

The rest of the marketplace is starting to trim headcounts, and the PMI data illustrates that issue. Also, note how weak new orders are in some of the sectors that drive manufacturing activity—also a concern.

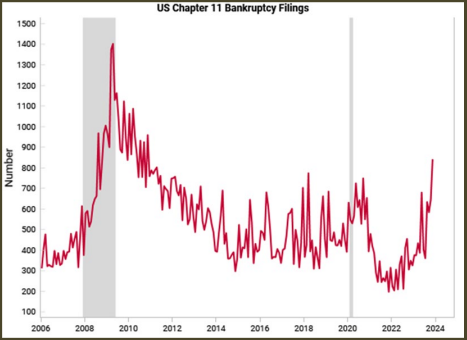

Bankruptcies – Noise or Trouble?

The chart below shows the number of Chapter 11 bankruptcies hitting levels not seen since 2010. This is just one data source, and there are many others showing various types of data related to this. One of the pieces of information missing here is the number of startups that would be entitled to Chapter 11 bankruptcy protection (which is almost any company or individual). It’s impossible to tell the denominator here relative to past cycles.

Still, given the lack of other data and the fact that some of the banking data shows commercial credit extensions hitting the second lowest levels since 2009, credit tightening, and savings still near historically low levels, one can give this bankruptcy data some credence. More clarity will come as cleaner data is released.

Surge in Air Travel

In 2020, the airline industry assumed that the pandemic had changed habits forever. People would no longer go on vacation trips, businesspeople would never do anything but use virtual meetings, and air travel would remain diminished forever. Pilots were offered early retirement, aircraft orders were canceled, and the industry prepared for the worst. These assumptions were wrong. The latest data from the IATA indicates that global air travel surged this year, and the airlines will be earning a record profit of $23.3 billion. That is nearly twice what had been predicted a few months ago. People want to travel. The business flyer is back in force, and doing one’s work in front of a screen has its limits. Face-to-face meetings, conferences, and trade shows are sporting numbers higher than before the pandemic, and the airlines are scrambling to keep up.