What Does the End of the UAW Strike Mean?

The UAW strike has ended. So, what did it cost the economy as a whole? What are the implications for the three companies, their workers, and consumers?

Throughout the strike, there were estimates as to the total cost to the economy. It is difficult to compute these accurately, but the estimates include $488 million in lost wages, $4.18 billion lost by the automakers, $1.86 billion lost by dealers, and $2.75 billion lost by suppliers. That is roughly $10 billion. One of the lasting impacts was the realization that US consumers were more than willing to shift buying preferences to vehicles made by other automakers. This fact will be important as the Big Three seek to recover market share.

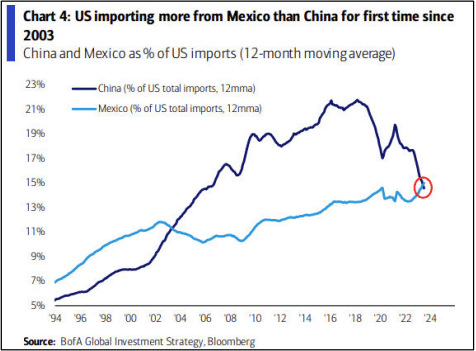

Details are still emerging, but it appears workers will receive a 25% pay hike over four years, cost-of-living allowances, and bonus payments for retired workers. There are also provisions designed to protect jobs, and these may be the most important part of the process. As the industry moves towards the production of EVs, there will be fewer jobs in existing plants, and new EV facilities will be overwhelmingly robotic. There has also been a major expansion of production into Mexico. The manufacturing sector in Mexico accounts for almost 90% of their exports, and automotive exports dominate. As the chart shows, Mexico now accounts for a larger share of imports into the US than China.

Details are still emerging, but it appears workers will receive a 25% pay hike over four years, cost-of-living allowances, and bonus payments for retired workers. There are also provisions designed to protect jobs, and these may be the most important part of the process. As the industry moves towards the production of EVs, there will be fewer jobs in existing plants, and new EV facilities will be overwhelmingly robotic. There has also been a major expansion of production into Mexico. The manufacturing sector in Mexico accounts for almost 90% of their exports, and automotive exports dominate. As the chart shows, Mexico now accounts for a larger share of imports into the US than China.

Analysts have asserted that this strike exposed the weakness of the US auto industry. The Big Three in the US are no longer the Big Three globally. That distinction belongs to Toyota, Volkswagen, and Hyundai. While the industry remains critical to the US economy, its status is sliding. The average price of a vehicle is now $47,000, and these new pay deals will add to that cost. US cars are now selling at a premium over foreign competitors.

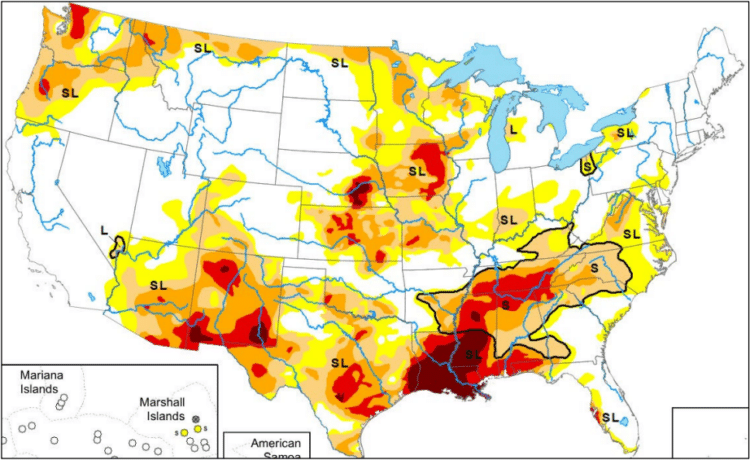

Drought Monitor Map Shows Stress Continuing Along Mississippi River

The drought has intensified along the southern part of the country, and the El Niño pattern that has created the situation doesn’t show signs of easing.

The latest drought monitor map shows the lower Mississippi Delta region seeing intensification of drought along critical waterways that connect the river to key ports in Louisiana and Mississippi. Barge traffic south of St. Louis may improve into the Arkansas area, but problems further downstream may still hinder barge traffic.

NOAA reported that the national drought situation across the upper Midwest improved slightly, but it might be too late to help cattle ranchers. Large round bales of hay are reported to be averaging $93 (a normal year is $35-$45). Some producers are reportedly taking livestock to market due to a lack of water and hay.

However, across some key growing regions in California and markets that have suffered in the past several years, growing conditions are good and drought conditions are almost non-existent. However, a dry pattern is setting back up across the Midwest, and that could stall recovery efforts over the next 30 days.

Economy Adds 150,000 and Unemployment Touches 3.9%

Bad economic news now equals good stock market news. After the recent lackluster labor report, stocks moved into positive territory. Although the jobs created were likely closer to expectations (and marred by the UAW strike and subsequent layoffs at nearly 40% of OEM supplier firms), the labor report was more goldilocks than anything (not too hot, not too cold).

The unemployment rate was essentially unchanged at 3.9% (up from 3.8%, but again, marred by the UAW strikes). The most important factor in the report was the wage figure. Wages remained relatively unchanged at 4.1%, which could be interesting news for the economy. The aggressive inflation figures show inflation of 3.2%. This differential will help consumer households (in general) if wages are growing at 4.1% and inflation is averaging 3.2%. That gap will allow consumers to slowly start spending on discretionary items assuming 1) that the data is correct and 2) that wages don’t adjust quickly through the remaining three months of the year.