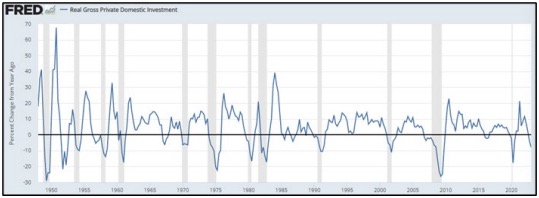

Private Investment Starts to Weaken

Total inflation-adjusted gross private investment is down nearly 8% year-over-year in the latest readings. Total investment was $3.5T through Q1, which is down from its peak in Q1 of 2022 of $3.8T. But it is in-line with pre-pandemic levels.

Breaking it down in simple terms, nonresidential construction is boosting it and is growing, as are investments in computer and software technologies. The government investments in infrastructure under the Infrastructure Bill are also helping push it higher. Pulling it lower are residential structures, equipment, and private inventories. In other words, the deceleration in investments would be deeper if it were not being bolstered by technology and nonresidential construction. Historically, drops in investment and corporate spending have led to a broader economic slowdown. With some tightening of lending standards, investment and spending are likely to be weaker.

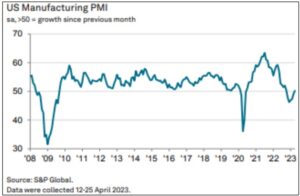

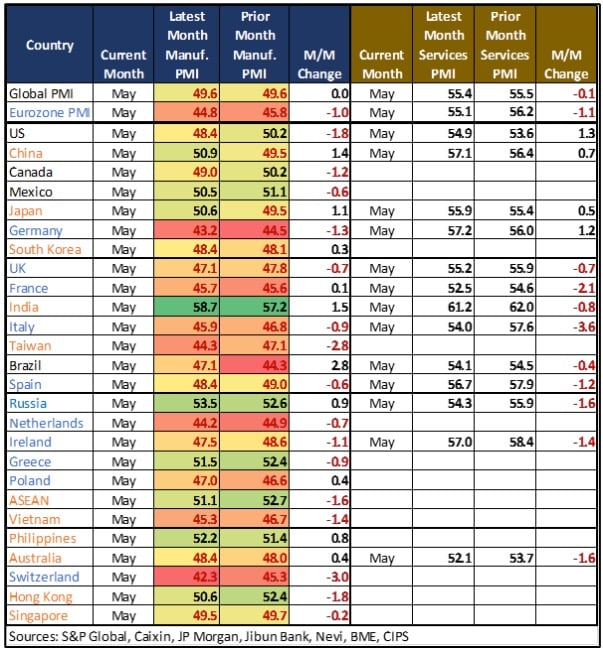

Services Sectors Worldwide Still Rockin’ and Rollin’

There is some great news on the global economic front, and it comes from the services sectors. Service sector spending is still robust in every market around the world that conducts and publishes services PMIs. Every country had services sectors that were still expanding (a reading over 50).

As long as consumers still have the wherewithal to spend on services, recession is likely to be avoided. And as long as there isn’t a lot of trouble in the services PMIs, there is hope for a soft landing in overall recession risk.

If there is any concern to point out in the data this month, it would be the deceleration. All but four countries experienced a deterioration in conditions.

Europe is on the watch list because the manufacturing sectors in those countries are signaling that they are in deep recession. The services sectors in Italy, France, Spain, and the broader Eurozone are showing deterioration in their services sectors. That could be a more concerning risk for recession overall. Only Germany in the European region had a positive month-over-month increase in services activity. Soon, the manufacturing sectors around the world should start to see peak season orders if they are going to get them this year.

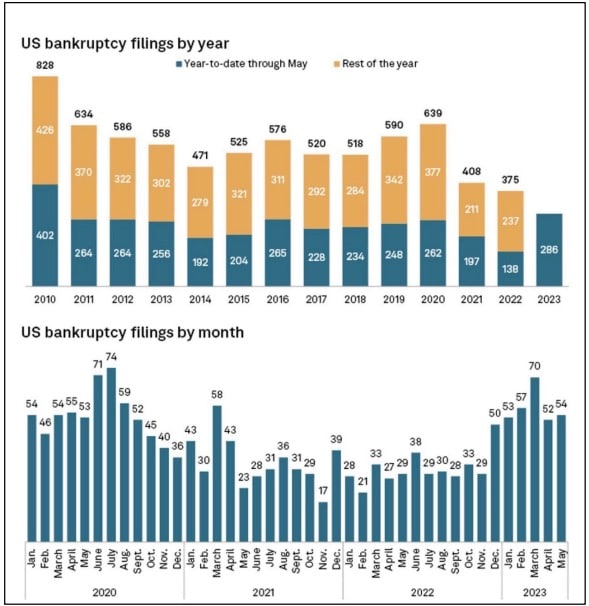

Bankruptcy Data Shows Strongest Since 2010

New data released by S&P Global shows that YTD bankruptcies may be the worst since 2010. To date, the tracker has found 286 firms have filed for bankruptcy (publicly traded or those with public debt and assets or liabilities greater than $2 million).

On the positive front, bankruptcies by month have not shown a dramatic change since December (despite a small surge in March). But largely there have been 50 a month over the past 6 months. Sure, that was higher than the months during the lockdown and the end of 2022.

But on the negative side, again this is the highest in 13 years and with bank credit tightening and many indicators showing that conditions continue to slow, everyone can expect the number of bankruptcies to continue to increase.

Executives in a number of different industries are unofficially reporting a noticeable change in spending habits over the past 30 days.

A group of motor vehicle dealers (trying to keep the specific brand private to protect the company) said last week that there has been a noticeable drop-off in consumer interest in purchasing. Of course, it could be summer vacations, etc. But even when compared to seasonality, sales are slipping below normal seasonal values. So, something is different.

Several business leaders privately echoed the same thing over the past 60 days, primarily from the B2B manufacturing sector.

This is just a heads up saying that economic conditions may not be improving as much as the stock market might show and as much as some analysts might want everyone to expect.

There are absolutely (unequivocally) segments of the economy that are still doing extremely well. New construction data shows a surge in non-residential construction across most sectors and services spending is still very strong. Indeed, there are many things to be optimistic about. But there are also some of these measures that one needs to keep in mind because they can become a drag on the growing segments.