Manufacturing Sector Reports Generally Show Light Improvement in April

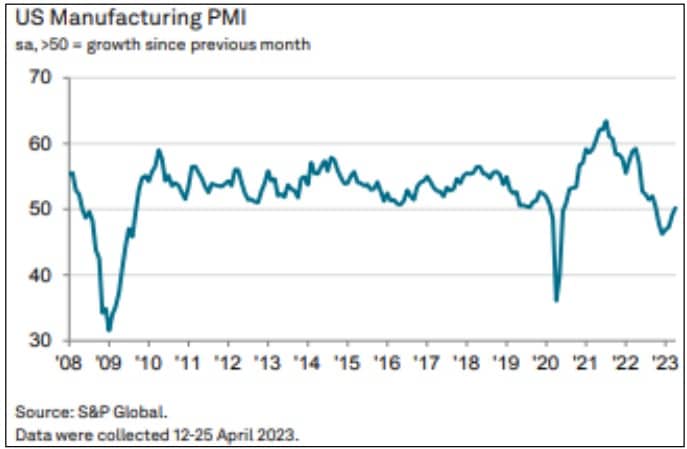

The two headline manufacturing reports for April, one from the ISM and the other from S&P Global, showed the manufacturing sectors tick higher. The ISM index still showed manufacturing in contraction while the S&P Global index shows it just slid slightly into expansion territory.

The big take-aways are that both surveys showed mild improvements in new orders, but importantly they showed some clearing of backlogs. As purchasing managers see some improvements in supply chain continuity, it helps with current production and alleviates backlogs. Only a few sectors are still reporting supply chain backlogs.

Electronics and electrical equipment backlogs on order fulfillment are falling. The manufacturing forecast this month showed that the outlook for manufacturing in this sector remains one of the more stable sectors in broader manufacturing. But, if it cannot get the key components that it needs to improve order fulfillment, total output will continue to suffer (despite the sector still having stable demand).

Both surveys also showed no improvement in inflation risk. Some input price inflation was still showing pressure, while output prices being received are under a little more pressure. The impact on profit margins could be more pronounced than it is, and some Q1 earnings reports did show the differences beginning to emerge between those firms that are managing the situation well versus those that are not.

The biggest differences in the two primary surveys are that the ISM survey includes government manufacturing and the S&P Global version largely does not. The ISM survey also has a larger percentage of larger firms whereas the S&P Global PMI has a mix of company sizes. They were telling the same story this month.

When one extends the view across Canada, the surveys show North American volumes stabilizing somewhat, but new orders are still slowing. Going into a more growth-oriented period of time, this suggests that customers are still being conservative with their inventory building strategies for the second half of the year.

Construction Spending Surprises to the Upside

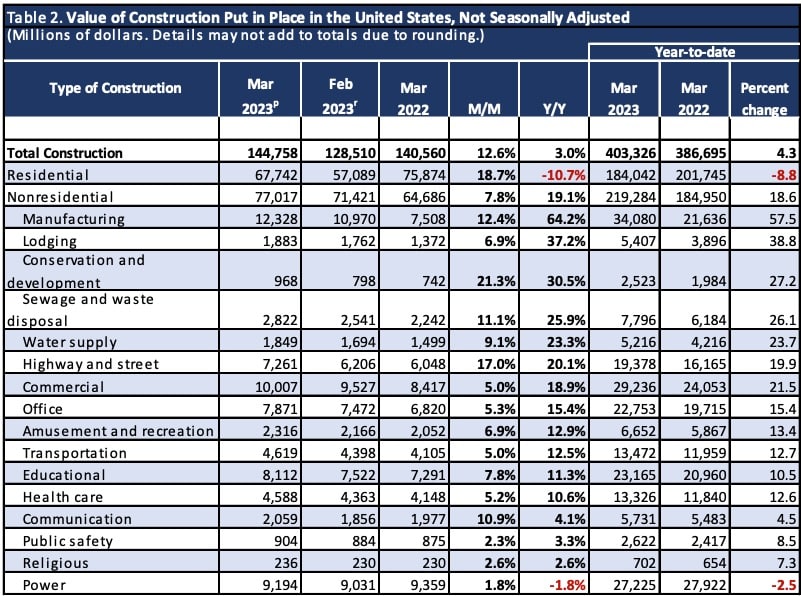

Construction spending lags by a month, so the latest data released shows March activity. But the report came in showing total construction spending up 3% year-over-year and surprisingly strong on a sequential basis after it rose 12.6% between February and March.

Residential spending was weaker, but even it shows some optimistic trends. Between February and March, residential construction spending was up 18.7%, despite still being down 10.7% Y/Y and 8.8% YTD.

New single-family construction was down 21.7% YTD while multifamily construction was up 24.2%. Interestingly, new single-family construction of homes was up 16.9% month-over-month. Some of this could have been weather-impacted activity, but the trend is interesting.

The nonresidential construction sector was up strongly by 19% Y/Y and 7.8% M/M and was also still 18.6% higher YTD.

Manufacturing construction spending was still the strongest subsector in the report; it continued to accelerate with growth of 64.2% Y/Y and 57.5% higher YTD vs. the same period in 2022.

The infrastructure sectors were still growing again this month, with growth ranging from 19.9% for highway and street construction to as high as 27.2% YTD increases for conservation and development.

Interestingly, construction of power facilities has slowed, but that is more of a function of availability of resources and materials for those projects and less about a lack of demand.