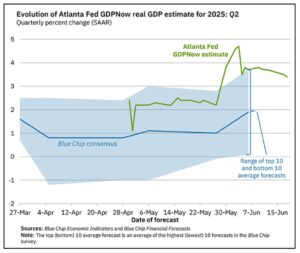

Q2 GDPNow Estimate at 3.4%

One could make the comment that the rolling estimate for Q2 GDP “cooled” to 3.4%, down from 3.8% in the prior weekly reading. But this is still a lot hotter than expected. Blue Chip analysts have even lifted their expectations for growth to nearly 2%, suggesting that the optimism over the economy is spreading further.

It could ease further in the coming weeks given the current hints of mild softening in some of the economic data released for May (for example: Advanced Retail Sales showed some month-over-month softening). But early estimates for GDP showed it coming in at 1% or less for the quarter, and those were well short of current activity.

Other components (which include fixed investment, intellectual property, and residual adjustments) were the biggest contributors. Much of this is tied to investment and spending on building-out datacenters, chip manufacturing, and other types of industrial construction.

Consumer spending has traditionally been about 70% of GDP. But in some quarters historically, other categories contribute a large percentage of GDP (which pulls the consumer spending percentage lower). Thus far, consumer spending in nominal dollars continues to be strong historically, but its contribution is lower because of stronger private investment and government spending.

No matter how one looks at it, this is a positive GDP reading if it holds through the official report. Hopefully, it will continue for the rest of the year and the pullback as a result of tariff pressure doesn’t slow it. Many major importers have yet to pass on tariff impacts because they are feeding off pre-tariff inventories. That is part of what will give the Fed challenging choices ahead.

Retail Sales Mixed in May

As mentioned earlier, there was probably a little bit for everybody in the May Advanced Retail Sales data. Month-over-month data was generally weaker noting some deceleration, but compared to last year, sales were still pretty solid.

Top-line retail sales were down 0.9% M/M but managed a 3.3% annual growth rate.

When one strips out fuel, gasoline, and food, core retail sales were also down 0.9% M/M but were 3.0% higher Y/Y. Compared to recent growth rates, this is considered firm, but not strong.

The problem comes when it is adjusted for inflation, which shows it was growing at a marginal 0.9% annual rate and was down 1% month-over-month – and that was with inflation rates fairly tame (relative to rates over the past several years).

Month-over-month, some of the early pulled-forward buying that took place as consumers tried to get ahead of tariff rates proved to be a trend in automotive primarily, with some additional noticeable impacts in home improvement.

Electronics and appliances may have shown some mild impacts from early pulled-forward buying as new sales slowed more in May.

E-commerce was growing at a healthy 8.3% annual rate, despite being sluggish month-over-month. There were pressures that hit de-minimus e-commerce sales (which would apply tariffs to small shipments and slow down foreign imports of e-commerce products). That took effect May 2nd, so this may have contributed slightly to pushing some spending to US markets which are captured in these retail sales – and reduces US import volumes at the same time. The key in this is to know that:

- U.S.-based e-commerce companies (e.g., Amazon) selling to foreign customers via their platforms are counted under non-store retail sales in the Advanced Retail Sales report.

- Purchases from foreign e-commerce platforms (e.g., Temu, Shein) by U.S. consumers are classified as imports, not retail sales. These transactions fall under customs data and are subject to duties unless exempt under de minimis rules (e.g., sub-$800 shipments).

Bottom line: The US consumer was generally still healthy in May, but there are some pockets of retail weakness showing up here. One can see that weakness also in housing markets and housing activity with reductions in spending.