Wage Data Shows Some Solid Income Levels

There may be some risk that wages are growing a little too hot to keep inflation in check, but the latest data is a good signal for anyone involved in discretionary spending categories.

The latest wage data from multiple sources showed that all private employees were still seeing wage growth of about 3.8%. Even when stripping out the upper-level executive cohort, nonsupervisory and production employees were still seeing growth in the 3.8% range.

The latest wage data from multiple sources showed that all private employees were still seeing wage growth of about 3.8%. Even when stripping out the upper-level executive cohort, nonsupervisory and production employees were still seeing growth in the 3.8% range.

Those switching jobs are still seeing faster wage growth of ~4.6%; those staying are still in that 3.8% range. The gap between the two is actually narrower than it has been in the last several years. That is important for executives to consider: you may have to work less to retain employees because the job jumpers are seeing that it is perhaps less lucrative to play the job market. Said another away, the job-jumper premium is diminishing.

By sector, again, every major category was seeing wage growth outstripping inflation. Information and technology was still the leader, especially for those positions that are AI capable. There is an AI premium on top of wages, and that is helping skew the sector, but IT proficiency outside of programming is still in high demand.

Surprisingly, manufacturing was second in durable goods, especially in the skilled trades, and forecasts are still showing worker shortages getting worse in the next three years. That could lead firms to hang on to workers more aggressively (including matching other job offers with wage increases). You can see the other sectors in the chart below. Again, this may help shape some of the budgeting that some businesses are doing – although it may not be specific enough for region and sub-sectors of the economy.

Lastly, lower end household incomes are seeing wage growth of 3.6% (still above inflation) while upper income households are seeing it in the 4.8% range. Again, both are above inflation.

One source noted that even the 10-15% wage increases for fast food workers in some states have already disappeared, and many of those workers have started to see those jobs disappear via store closures, relocations, or automation trends that are keeping margins intact (business operators must increase product/service prices or reduce headcount – there are no other basic choices).

Global Economic Data Delivers Stable November

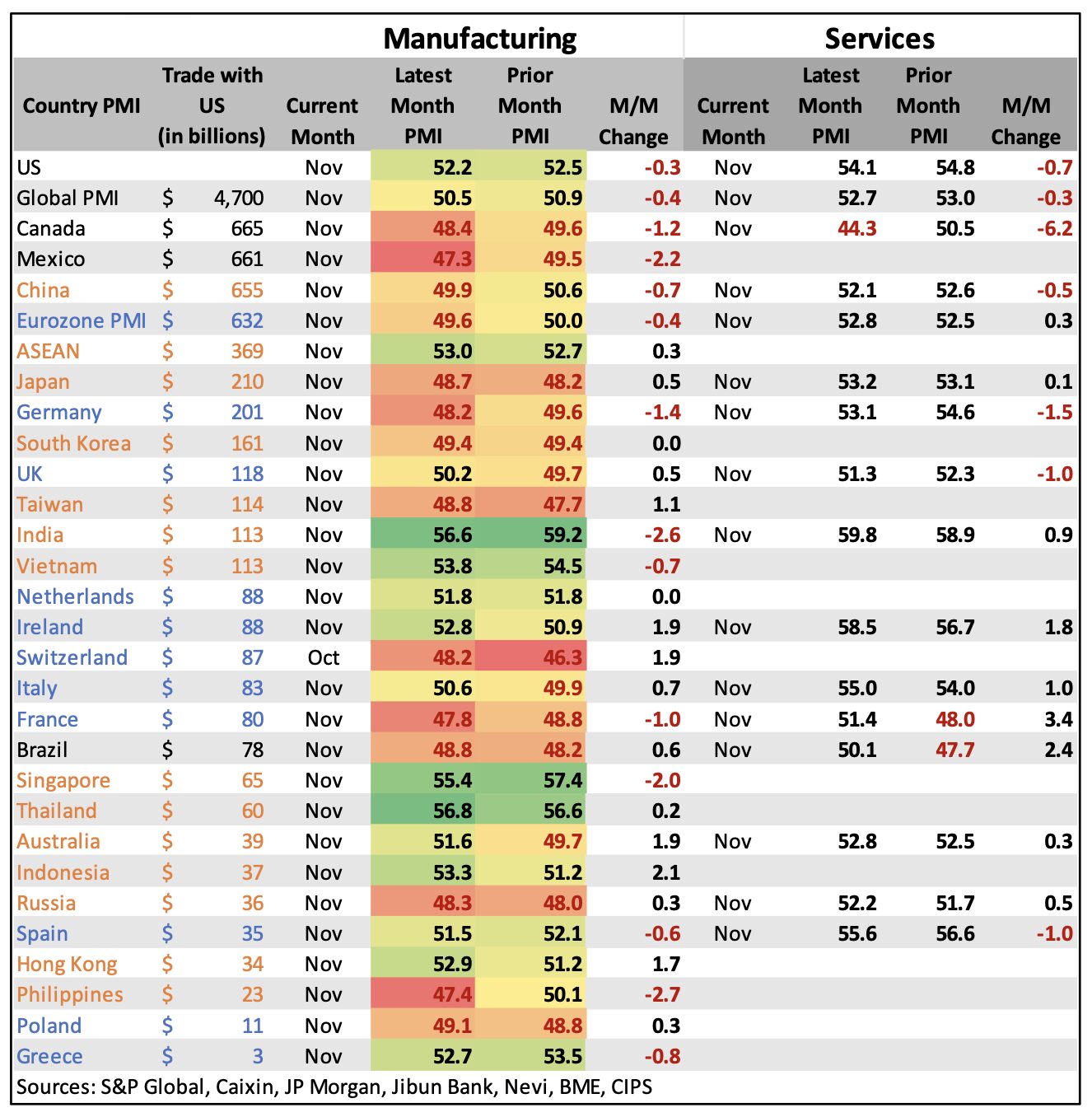

The latest monthly survey results show what has turned out to be a lukewarm month. On a global (comprehensive) level, manufacturing and services sectors were both down month-over-month, but manufacturing was showing just mild expansion while services sectors were stronger.

The services sector typically dominates most developed nations’ GDP. In most economies, it can contribute between 60-70% of GDP. Economists look to these sectors most in trying to determine whether a country is in recession or an expansion phase.

The services sector typically dominates most developed nations’ GDP. In most economies, it can contribute between 60-70% of GDP. Economists look to these sectors most in trying to determine whether a country is in recession or an expansion phase.

Therefore, saying that only one major group had a services sector in contraction is a pretty solid statement for global spending. And the Canadian survey is fairly ne, so a reading of 44.3 may not be that accurate.

It is tough to see how Canada can be in recession (both manufacturing and services sectors in contraction) while countries like the UK, Germany, the Eurozone, etc. are showing both sectors in expansion. Canada has been hit economically with tough trade uncertainty, but generally the services sector should continue to be growing – and this measure is in deep contraction at 44.3 points.

Across the world, business leaders are generally confused. They want to be optimistic about 2026, but uncertainty is still prevailing – and dominating their mindset. It makes them approach cash retention conservatively, and they remain reserved with investment and spending.

Right now, the market is looking for the next consumer-level growth engine. Many thought that AI and robotics would be that engine – but until robotics hits a household level (each household providing individual adoption opportunities), everyone may still be waiting for the great catalyst to show up.

NAR Housing Forecast for 2026

The National Association of Realtors released its latest forecast for 2026, and it showed a potential 5% increase in new home starts in 2026. This would push starts from ~1.31 million this year (~1.35M in ’24) to ~1.45M in 2026. That increase of 140K more homes would create effectively 980,000 more full truckloads of freight demand, if historical ratios hold. This forecast improvement will depend on the Fed lowering interest rates, and more importantly, the 10-Year US Treasury yields following them down.