Long and Short of Consumer Price Index and Tariffs

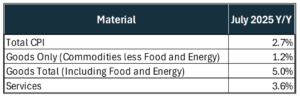

The short answer on tariffs and inflation through the Consumer Price Index (CPI) is that they were having little impact. The bottom line is that tariff inflation was marginal.

Many business owners could say where price inflation has hit them (or where they have passed it on to somebody). But at a macro level, it is being partially eaten throughout the supply chain, and most of the impact is still muted.

One of the staunchest opponents to tariffs said recently that they anticipate a one-time hit to inflation of 3 tenths of a percent, pushing overall inflation (measured in the Fed’s favorite Personal Consumption Expenditures PCE – not in the CPI reflected in this article) to 3.1%. That’s nothing close to 2021-2023 during the global supply chain crisis. Even the Fed is forecasting it to fall back to 2.4% in 2026.

When one gets aggressive with the figure, it jumps to 5%, but on the back of sharp increases in:

Meat (primarily beef shortages)

- Coffee

- Sugar

- Food away from home (wage pressure)

- Natural gas (up 13.8%)

- Electricity (up 5.5%)

None of those were impacted by tariffs – all were impacted mostly by supply-side issues.

Based on what one hears from supply chain managers, there are still some price increases on the way. Here is how the market seems to be absorbing tariff rates:

- Suppliers eating part of it (~10%).

- Some of it absorbed in supply chain (carriers) (~10%).

- Around 10% being eaten in margin.

- Rest likely to be passed on.

This current mix is likely not sustainable long term; eventually, it will evolve into a one-time price adjustment (by Q4 or Q1 ‘26) because the suppliers and supply chain can’t continue to take deep discounts to soften the impact. But again, everyone agrees that it is a one-time, market price adjustment, and then future inflation risk will fall back on normal annual increases based on other market-based factors primarily tied to supply/demand.

That doesn’t change the fact that a T-shirt from a big box retailer might go from ~$4 to ~$5 in that one-time price hit, but the price will stick there, and the annual rate of change will fall back into a reasonable rate from then on. For now, perhaps those price increases are spread out over thousands of products, and they’ll hit at different times, but it isn’t having a material impact on the macro data at this point.

Read MORE.

Don’t Look Now – Mortgage Rates Down

The 30-Year US mortgage rate has hit an average of 6.53%, the lowest rate since October of last year. Compared to rates after the Great Recession, these are still higher. It is interesting that depending on what generation you fall into, this may seem incredibly high or incredibly low. Most analysts agree that we will likely never see the 2% ranges from the past decade. But as rates come down, it has a profound impact on the economy.

Beyond the obvious that it helps spur the residential housing market (which can account for as much as 16% of GDP) and drive more than 7 full truckloads of fixtures and products for every single-family home built, it has a strong impact on other types of spending.

Refinancing can add $150-$350 a month to the average household if rates drop by a full percentage point. That spurs spending for cars, boats, and other types of big-ticket purchases that might have a monthly payment attached to them.

What’s Driving Q3 GDP?

The latest data from the Atlanta Fed shows Q3 GDP growing at 2.5%, ahead of Blue-Chip estimates for just 0.8% and some private predictions of ~1.5%. The data found that it was largely in areas that it should be (for a healthy economy) and was being driven by:

- Consumer spending, accounting for 55%

- Inventory building activity ~32%

- Nonresidential fixed investment ~15%

- Residential and Government ~12%

- Net exports ~-15%

Some of the provisions in the OBBBA (plus a Fed that is likely to be easing rates into the second half of ’25) could release more investment there. And if the housing market starts to show some signs of recovery, which could lift the residential component. Q3 is typically boosted by inventory building activity, which fades in Q4; hopefully, those other components will have accelerated by then.

Meat (primarily beef shortages)

Meat (primarily beef shortages)