More Tariff News

The tariff threats of 35% on Canada, 50% on Brazil and a host of smaller countries by August 1st is banter at this point. Everyone can deal with the repercussions when there is some official notification that a tariff is in place. But one can’t ignore what it is doing to markets and some commodity prices, because firms are moving on the threats.

As an example, copper prices hit a new all-time high recently; prices are up 34.7% YTD and are up 21.0% Y/Y. Early stockpiling to get ahead of tariff threats (50% hike coming) has pulled global inventories down and has begun to create some tough ripples through many industries. At some point, companies will run out of pre-tariff inventories, and then these tariffs will get passed on. As much as one might want to ignore these negotiations, those who look away might get hurt.

Maritime Rates Plummet

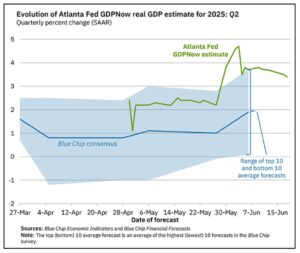

The recent lack of new orders headed toward the US in the wake of the 90-day tariff whipsaw is illustrated in the prices being charged by maritime providers and the reasoning behind that drop in prices.

For the US, lanes connecting Shanghai and LA are down 61% Y/Y, and those connecting to NY are down 48%.

But it might be the recent week-over-week data that is particularly concerning. There is nothing headed this way from those key markets. Rates on a weekly basis are down 5% in northeast-bound markets and down 8% in west coast-bound markets. That is incredibly low for this time of year as companies try to load fall seasonal merchandise. They’ve just all preloaded it, and there’s nothing chasing it (new orders are down, and the Drewry data shows no price escalation coming out of those markets).

This drop in pricing still comes with the Red Sea in flux (that volatility would normally push maritime rates higher). Two ships have been sunk in the last week, and movement through the Red Sea and into the Suez Canal is going to be reduced once again until the US and Israel strike those Houthi positions.

Thus far, publicly released information and discussion from the US/Israel has been quiet in that area – which typically means that a much larger scale operation is possible in the coming days. And remember that Netanyahu visited the White House weeks before the Iran attack, and he was just in the White House again recently. There may be some additional activity in the region to try and open up that freight flow (by hitting Houthis positions).

A New Look at Labor Shortages and the Impact on AI

Everyone has seen the estimates that there are about 45% of the existing jobs in the US that could potentially be replaced by AGI (Artificial General Intelligence) by the year 2035. The June labor report showed a loss of about 7,000 professional and business sector jobs. The slide below illustrates the problem.

Baby boomer retirements will cumulatively touch 21.7 million by 2030. Over the same period of time, the US will add naturalized workers of about 2.3M to 3.2M (this could be higher if there are controlled worker VISA programs being used). AI is projected to replace 4 million jobs over that period of time (it could be higher but could also be lower). And over that period of time, the US is expected to add a million AI-driven jobs.

Taking all of that into consideration, estimates are there could be up to an 18 million worker shortage by 2030. Now, there are a lot of factors that could move that up or down by 4-5 million (immigration policy changes, personal robotics, and adoption of those technologies, etc.). To put that number in perspective, today there are 7.6 million jobs open.

The problem is in the near term. Stated plainly, Baby Boomers are likely to retire at a slower pace than AI replacement – causing a near-term job mismatch. However, that adjusts over time as Boomers do retire, and the pendulum will swing the other direction. This will be the challenge to work through – but it will be important to keep this data in mind so that data is not misinterpreted. Business owners still need to consider how to operate in a tight labor environment long term.