Bonds Surge

Many ask why mortgage rates are climbing despite the Fed’s trimming interest rates. Mortgage rates are tied to the 10-Year Treasury. There is speculation in the bond market that the new administration will lead to faster economic growth, resulting in higher inflation. That higher inflation would push the Fed to reduce plans for cutting interest rates (and that speculation was pushing yield rates on the US Treasury higher). But there has been another matter at work. To service the Federal Deficit, the Treasury is having to find a way to issue double the number of bonds (@$2 trillion) this year as they did last year, and they had to restructure nearly $8.9 trillion in older bonds. That much supply thrown on the market forces the Treasury to offer more in yield rates to keep investor interest. So far, treasury auctions have been met with interest, but the surge in yields suggests the Treasury is having to work harder to find interest (see the chart below). Higher yields equal higher mortgage rates, regardless of what the Fed does. Reducing the deficit is the only answer, and that takes time.

Many ask why mortgage rates are climbing despite the Fed’s trimming interest rates. Mortgage rates are tied to the 10-Year Treasury. There is speculation in the bond market that the new administration will lead to faster economic growth, resulting in higher inflation. That higher inflation would push the Fed to reduce plans for cutting interest rates (and that speculation was pushing yield rates on the US Treasury higher). But there has been another matter at work. To service the Federal Deficit, the Treasury is having to find a way to issue double the number of bonds (@$2 trillion) this year as they did last year, and they had to restructure nearly $8.9 trillion in older bonds. That much supply thrown on the market forces the Treasury to offer more in yield rates to keep investor interest. So far, treasury auctions have been met with interest, but the surge in yields suggests the Treasury is having to work harder to find interest (see the chart below). Higher yields equal higher mortgage rates, regardless of what the Fed does. Reducing the deficit is the only answer, and that takes time.

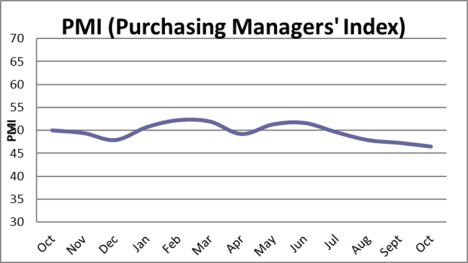

PMI New Orders

Read a complete economic overview in the latest edition of the Holman Executive Brief.

Peru’s Chinese Megaport

Over the last year or two, the Chinese have been constructing one of the largest ports in the world in Peru – the port of Chancay. This $3.6 billion project is set to transform the shipping world along the Pacific as the intent is to create a Latin version of Singapore. This will be a deep-water port capable of handling the largest container ships and other vessels. The prime limitation will be the land-based infrastructure as there will be challenges in terms of getting cargo to the port and distributed through the region. It is being developed with the cooperation of the largest mining company in Peru, and the focus will be on getting Peruvian copper and other materials to the global market. There is also a good deal of interest on the part of food producers in the region.

The prime concern on the part of the US is that this project will be under total Chinese control. It is being built and paid for by Chinese companies with government help. There is a possibility that Chinese warships will be able to use this port along with the commercial fleets. The port will also develop at the expense of rival operations in the rest of Latin America, especially the facilities that are under development in Mexico.