Could Inflation Continue to be Higher?

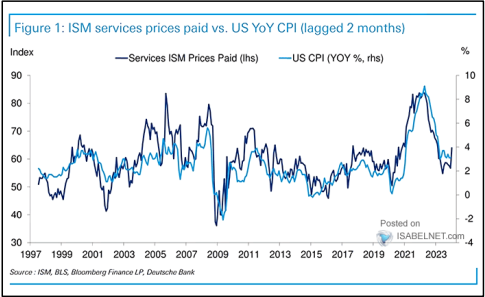

Bloomberg released a graphic showing a correlation between the ISM Services Prices Paid index and the Consumer Price Index. The ISM measure surged this month – what does that mean for inflation? It is possible that there will be a cooler CPI reading, but the ISM survey shows inflation going the wrong way. Analysts are frustrated because of the significant adjustments to data months after initial release. It makes the Fed’s job more difficult. Again, if the CPI does not follow the ISM, it will be suspect. If it does follow it, the Fed has more work to do.

OPEC to Keep 2M BPD Cuts Through Q2

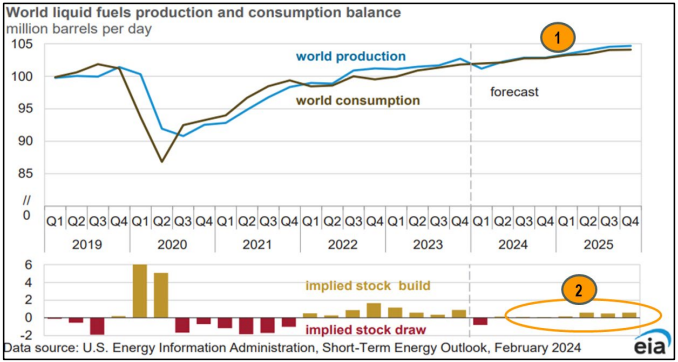

OPEC has vowed to keep the current 2 million barrels per day cuts through Q2. Those cuts will not change current production volumes, but there will be an impact on the demand side. If production remains flat but spring/summer consumption ticks up, it will support prices. Crude prices haven’t moved much; WTI is still in the mid to high $70’s while Brent is just over $80 a barrel. The EIA predicts this level will continue through 2024 and into 2025.

Item number one to the right shows the EIA forecast roughly balanced between supply and demand for the next 8 quarters. That is one reason prices remain unchanged. But it assumes that total world output continues to rise. Any impacts to output would change the calculus. Item number 2 shows a net building of inventories if these ratios hold through 2025, and this short-term energy outlook released by the EIA includes the OPEC cuts through the end of the second quarter.

Item number one to the right shows the EIA forecast roughly balanced between supply and demand for the next 8 quarters. That is one reason prices remain unchanged. But it assumes that total world output continues to rise. Any impacts to output would change the calculus. Item number 2 shows a net building of inventories if these ratios hold through 2025, and this short-term energy outlook released by the EIA includes the OPEC cuts through the end of the second quarter.

There are several factors to consider. Global manufacturing activity is improving, which may increase demand for fuels, chemicals, etc. There is likely to be an active hurricane season that could affect Gulf of Mexico production. It is not known what that would do to overall output in the US. The Permian Basin has become so efficient that it might compensate (or help the industry recover faster than normal).

The big issue could be refinery activity and capacity. After heavy maintenance this spring, refiners should be able to produce at rates that will keep prices stable. But, again, any Gulf hurricanes could impact refinery infrastructure.

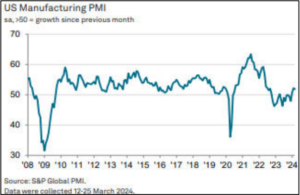

Factory Orders Fell Sharply in Q1

Federal data on manufacturing showed factory orders dropping 3.6% in January, ahead of analysts’ expectations of 2.9%. Durable orders were among the weaker components, falling 6.2%. But nondurables were down 1.1%. The inventory to sales ratio inched up in January as a result of faster inventory building and weaker new orders. Monthly manufacturing reports for February showed that new orders were sluggish. The ISM had new orders inching back into contraction (at 49.2 points), but they were weaker than in January. The bottom line: new orders are weaker than expected.

Why Are the Houthi Attacks Still a Threat?

The Red Sea remains virtually impassable as ships continue to be attacked by Houthi rebels, and attacks are not directed only at ships moving cargo to/from Israel. The attacks have been taking place even as many western nations have destroyed rebel hardware and killed hundreds. This retaliation should have made a big difference, but the rebels seem to have an unlimited arsenal of weapons and people.

The intelligence community is now admitting that it had no idea how much weaponry the Houthi had. Current estimates assert they have 10-100 times the armament assumed at the start. This means the attacks could extend for years. This and other intelligence failures call into question many assumptions regarding modern warfare. The Israeli intelligence community missed the Hamas build up. The assessment of the Russian forces entering Ukraine was flawed. There has been misreading of terrorist strength in Africa, and many question how well the US understands the Chinese threat to Taiwan.

Intelligence communities are not about to reveal what they do and do not know, but there has been a lament from within these communities: too much reliance on technology and too little emphasis on human intelligence. The fact is that recruiting agents to penetrate an enemy is costly – in money and lives lost. It was assumed technology could do the job, but it seems easier to hide from technology than assumed.