Manufacturing Reports Show Slowdown Continues

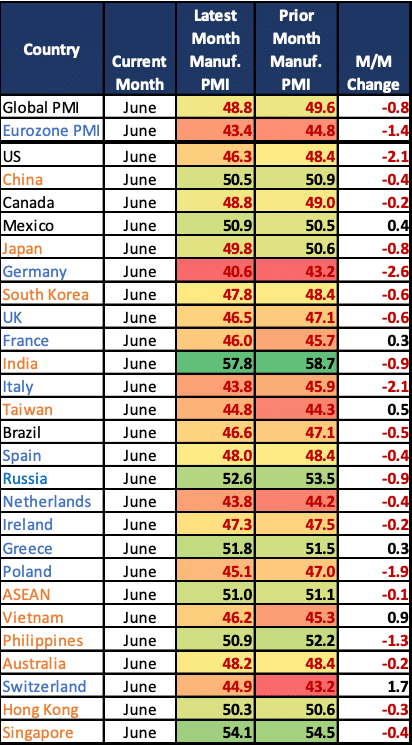

There was a concerning trend in the latest monthly Purchasing Managers Index reports; all but six countries had manufacturing sectors that deteriorated in June. This is seasonally not a good sign. Typically, one would see some increases in manufacturing activity heading into the busy peak season.

The one bit of good news is that many countries reported one of their fastest drops in input and output prices in more than ten years. This is a sign that inflationary pressures on products are starting to ease.

The US headline PMI from S&P Global came in at 46.3, down 2.1 points from 48.4 in the prior month. US manufacturers continue to report (across multiple survey instruments) that new orders are falling across the sector. Some improvement in new orders is still being seen in some pockets.

Official Federal factor orders data (which lags a full month) were up just 0.3% month-over-month against expectations for an increase of 0.8%. Versus last year at this time, they were down 1%. Interestingly, durable goods that could often be more sensitive to higher interest rates carried the month, up 1.8%, but cheaper non-durable goods were down 1.2%.

Around the world, 19 countries still have manufacturing sectors in at least mild contraction, and some are in deep recession.

Germany stands out among national PMI readings; its PMI plummeted to 40.6 points (50 is the midpoint between expansion and contraction). The chokepoint on the Rhine River at the Kaub hit an all-time seasonal low point. This can disrupt significant flows of products (especially inputs of raw materials and energy) and may become a factor slowing down any recovery in the German manufacturing sector.

The bottom line is that only six countries experienced an improvement in their PMIs in June. Among those, only two of those countries had manufacturing sectors that were expanding; the remaining four had manufacturing sectors that were “less worse” but still in contraction, and in the case of Taiwan, France, Vietnam, and Switzerland, the contraction is substantial.

At this stage, there is no sign that the peak season will bring a lot of product movement activity. Or, it may be a signal that the peak season could come a bit later in the season – some smaller retailers waiting to see how strong back-to-school is before setting their peak season order levels.

Economy Added 209,000 Jobs in June, Short of Expectations

The jobs market was best described as a goldilocks report (not too hot, not too cold). It was about right, but probably too hot for the Federal Reserve. However, when one looks at the various layers, there are some interesting pieces in the data that suggest maybe some cooling is taking place.

Again, there were 209,000 jobs created in June, short of the 233,000 estimated by economists. The unemployment rate came in at 3.6%, down from 3.7% last month, but the U-6 rate was higher at 6.9% (6.7% last month) but remains historically below average.

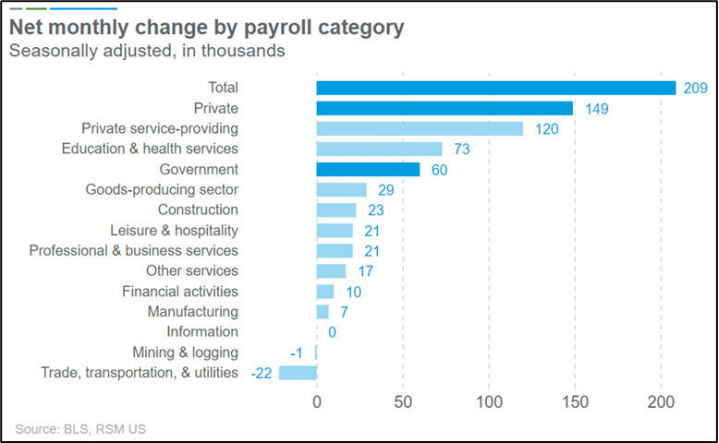

Here is a nice summary of the jobs data from Joseph Bruseuelas. It shows the breakdown of the jobs data and where the jobs were created in June.

Education and healthcare jobs were at the top of the sectoral list at 73,000; Government also added 60,000.

Construction was up 23,000 as the non-residential, infrastructure, and even single-family sectors continued to be strong headed into the summer.

Job openings are still probably too plentiful at 9.8 million (normal 6 million). As layoffs increase, people are almost immediately finding new jobs. The economy has absorbed 500,000 jobs between April and May, so the job market was showing signs of tightening over the last month.

Among industries expecting to add employees, most will be in entertainment/leisure (but those are still down 81% from last year’s hiring intentions announced in June) followed by technology (but those announcements are still down 61% from last year’s hiring intentions).

Transportation Demand Index Flattens in June

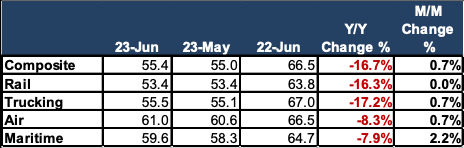

The Armada Transportation Demand Index (TDI) came in slightly higher in June. More importantly, there were signs of life in a few of the specific modes of transportation, with maritime popping by 2.2% M/M.

The rail sector is being helped by the commodities sector, but overall growth for the sector is flat M/M, and it was 16% weaker than it was last year. Some cross-border activity also showed signs of slowing, and PMI reports showed sluggishness in the data.

Lastly, air and maritime were both showing some solid improvements in activity, down from last year but much less than other sectors in the report. Both sectors are off nearly 8% year-over-year despite air cargo being up 0.7% M/M and maritime being sharply higher by 2.2%.