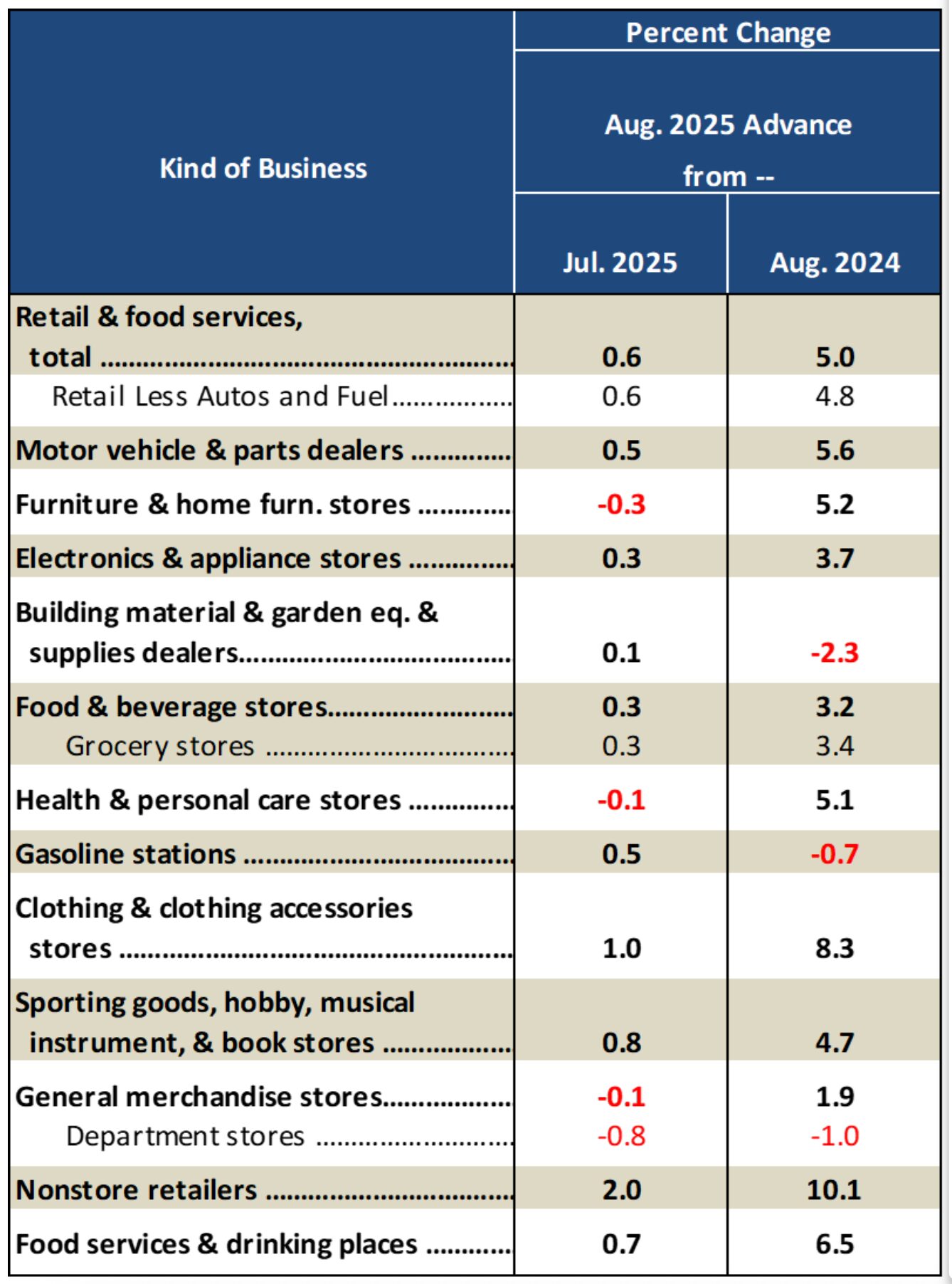

Retail Sales Above Expectations

Top line retail sales in August surged by 5% Y/Y – which was ahead of expectations. The Y/Y is used to eliminate some of the back-to-school seasonality. Many categories tied to back-to-school were doing much better – e-commerce (which is how many parents are buying school supplies these days), clothing/apparel, and sporting goods were notably higher.

Top line retail sales in August surged by 5% Y/Y – which was ahead of expectations. The Y/Y is used to eliminate some of the back-to-school seasonality. Many categories tied to back-to-school were doing much better – e-commerce (which is how many parents are buying school supplies these days), clothing/apparel, and sporting goods were notably higher.

Auto sales were up a sharp 5.6% over last year’s volumes. This is well beyond the impact of tariffs and could signal that many consumers are using the tax bill provisions for auto sales deductions. Food at home and food away from home were strong, and even electronics and appliance stores, furniture, and other discretionary categories were strong. The coming weeks will show if there was a surge in use of credit to make these purchases or if this was another sign that the consumer is still strong and there will be a solid peak retail season.

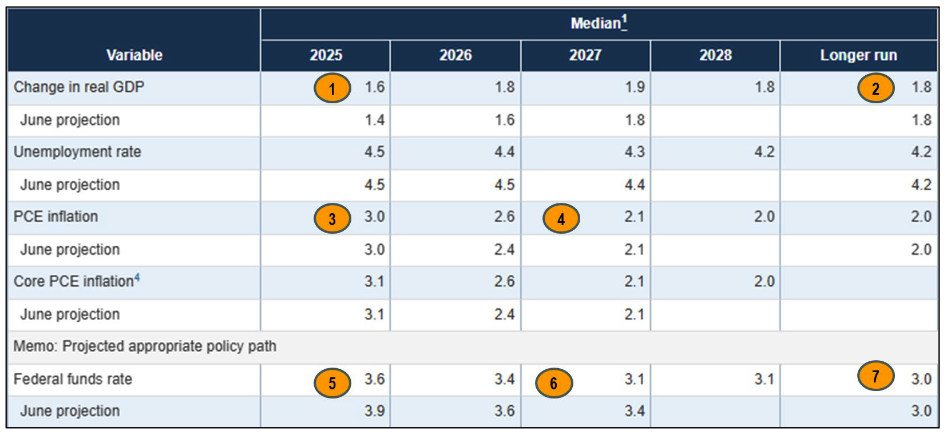

Key Takeaways from the Fed Forecast

The FED trimmed a quarter point, as expected. But the Fed is seeing confusing data, and even their own forecast is confusing (relative to their actions).

So, here are some takeaways from the Fed forecast (which is the table below).

- They increased their forecast for US GDP in 2025 from 1.4% to 1.6%. That’s interesting, because they admit that the economy is heating up, but the Atlanta Fed has growth at 3.3%, and if Q4 came in even at the historical average, 2025 would come across the finish line above 2.2%.

- Long-term rates are unchanged, but 2026 and 2027 forecasts have also been pushed up a bit. Recession risk is not in the forecast at this point.

- Inflation is still at 3% this year. This is largely the tariff impact hitting and then dissipating. Inflation pressure remains a slight problem.

- The Fed increased its concern over inflation a bit in 2026; they see it remaining at about 2.6%. That assumes that the problem from tariffs lingers before hitting near their 2% target rate in 2027.

- The Fed forecast still shows two more rate cuts for 2025. Likely a quarter in October and another in December.

- Only two more cuts after that, one in 2026 and one in 2027.

- The long-term terminal rate is expected to be 3%. For those anticipating 2-2.5% long-term, that’s not in the cards at the moment, according to the Fed.

The Fed said it was worried about labor conditions, and that that worry justified trimming rates. They didn’t change their forecast for unemployment, however, and it remains at a historically lower level through 2027.

So, the formula doesn’t add up. The economy is growing, inflation pressure remains, and no real change in employment based on their forecast – why cut?

Chairman Powell said it comes down to some weak labor signals. They seem to believe that companies are not expanding faster or hiring quicker because rates are too restrictive. But they overdid it.

Unemployment isn’t rising too fast, but companies are also not hiring. They are allowing attrition and retirements to lower costs – but headcounts are essentially dropping.

After fear earlier in the month that unemployment rates were spiking, they eased recently. Everyone (including the Fed) is still getting mixed messages.

Labor data is a lagging indicator. By the time one sees problems with labor data, it’s too late. The damage has been done. And that’s perhaps the best rationale for the Fed acting here.

August Manufacturing Mixed

There are two different readings on manufacturing coming from monthly surveys. The ISM report on manufacturing (heavily concentrated with larger firms) came in at 48.7, still in contraction but slightly better than the 48.0 in July. New orders shot up to 51.4. Inventories are low, and prices were elevated but flat.

S&P Global’s survey (which includes a broad mix of company sizes) came in hotter, registering 53.0, up from 49.8, and the strongest improvement since May of 2022. New orders rose for the 8th month in a row, with survey respondents indicating that growth in new orders was “improving noticeably since July.”

A concern is that prices in both surveys were showing tariff-driven price increases. But generally, the reports are mixed on how much of that input price increase is able to be passed on to customers.

Overall, some sentiment was improving slightly as companies shifted some sourcing to US manufacturers. Job stability and new job growth were also seen in manufacturing through July.